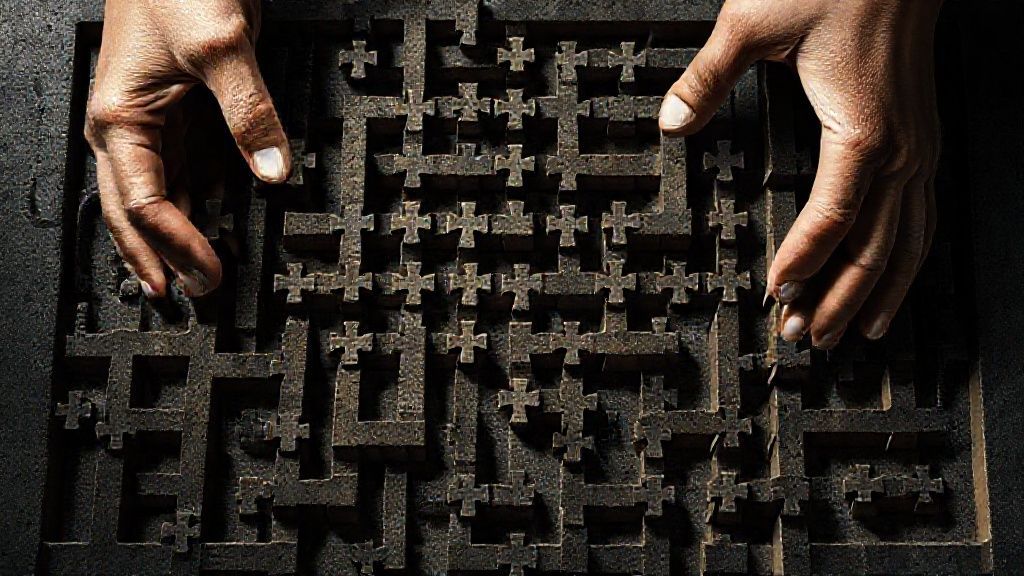

Navigating the Tax Maze: Freelancer Accounting & Crypto Compliance

Freelancer Tax & Crypto Tax Simplified. Guides for remote workers on foreign income, accounting software reviews, and legal tax deductions globally.

Navigating the Tax Maze: A Freelancer's Guide to Accounting & Crypto Compliance

Ah, the freelance life! The freedom to choose your projects, set your hours, and be your own boss. It’s a dream for many, but let’s be honest: with great freedom comes great responsibility – especially when it comes to taxes and accounting. For many freelancers, the thought of tax season brings a cold sweat, and if you’re dabbling in cryptocurrency, that complexity often doubles. But what if it didn't have to be a nightmare?

This guide is designed to demystify the world of freelance taxes and accounting, including the often-confusing realm of crypto. We’ll break down what you need to know, offer practical tips, and help you build a solid financial foundation for your independent career. Ready to take control?

TL;DR: Freelance taxes, including crypto, don't have to be overwhelming. This guide covers essential accounting practices, understanding self-employment and estimated taxes, navigating crypto tax rules (capital gains vs. income), and crucial compliance tips. Learn to track income/expenses, use the right software, and avoid common pitfalls to ensure a smooth tax season and financial peace of mind.

Table of Contents

- The Freelance Tax Landscape: What You Need to Know

- Essential Accounting Practices for Freelancers

- Decoding Crypto Taxes for Freelancers

- Compliance & Avoiding Pitfalls

- Tools & Resources to Simplify Your Life

- Frequently Asked Questions

The Freelance Tax Landscape: What You Need to Know

Stepping into freelancing means you’re no longer just an employee; you’re a small business owner. This shift brings a whole new set of tax obligations. The biggest one? Self-employment tax. This isn't an extra tax; it's how you pay into Social Security and Medicare, which your employer would normally withhold and match if you were traditionally employed. For 2024, this rate is 15.3% on your net earnings (12.4% for Social Security up to an annual limit, and 2.9% for Medicare with no limit).

Beyond self-employment tax, you'll also owe income tax. Since no employer is withholding taxes from your paychecks, you’re responsible for paying estimated taxes throughout the year, typically quarterly. Missing these payments or underpaying can lead to penalties, so it's crucial to get this right. How do you estimate? Look at your previous year's income, project your current year's earnings, and factor in your deductions.

Understanding Deductible Expenses

This is where freelancers can really save money. Almost anything "ordinary and necessary" for your business can be deducted. Think about:

- Home Office Deduction: If you have a dedicated space used exclusively and regularly for your business.

- Business Software & Subscriptions: Project management tools, design software, accounting platforms.

- Professional Development: Courses, workshops, books related to your craft.

- Marketing & Advertising: Website hosting, business cards, online ads.

- Health Insurance Premiums: If you're self-employed and not eligible for an employer-sponsored plan.

- Travel & Meals: Business-related travel and a portion of business meals.

Real-World Example: Sarah, the Freelance Graphic Designer

Sarah, a freelance graphic designer, diligently tracks her expenses. Last year, she invested in a new design software subscription ($600), attended an online branding workshop ($300), and used a portion of her apartment exclusively as a home office (qualifying for a $1,500 deduction using the simplified method). She also paid for her own health insurance ($4,800). By deducting these legitimate business expenses, Sarah significantly reduced her taxable income, saving hundreds, if not thousands, on her overall tax bill. Without careful record-keeping, she might have missed these valuable savings.

Essential Accounting Practices for Freelancers

Good accounting isn't just about tax time; it's about understanding your business's health year-round. It helps you make informed decisions, manage cash flow, and avoid financial surprises.

Separate Your Finances

This is non-negotiable. Open a separate bank account and, ideally, a separate credit card for all your business transactions. Mixing personal and business finances makes tracking income and expenses a nightmare, complicates tax preparation, and can even blur the lines of liability if you operate as an LLC or corporation.

Diligent Record Keeping

Every invoice sent, every receipt received, every payment made – keep a record. Digital is often best. Scan physical receipts, save digital invoices, and categorize everything. This isn't just for deductions; it's your proof of income and expenses if the IRS ever comes knocking. Cloud-based storage solutions are your friend here.

Choosing the Right Accounting Software

Gone are the days of manual ledgers (unless you really love them!). Modern accounting software can automate much of the heavy lifting. Tools like QuickBooks Self-Employed, FreshBooks, or Wave Accounting (for free) can link to your bank accounts, categorize transactions, generate invoices, track mileage, and even help estimate your quarterly taxes. The key is to pick one you're comfortable using consistently.

Real-World Example: Mark, the Freelance Writer

Mark, a freelance content writer, used to dread tax season. Receipts were stuffed in a shoebox, and he'd spend days trying to piece together his income and expenses. After a particularly stressful year, he decided to try FreshBooks. He linked his business bank account, and now, as soon as a transaction hits, he categorizes it. When he sends an invoice, it’s automatically recorded. At the end of each quarter, he can generate a quick report to see his profit and loss, making estimated tax payments much less of a guessing game. He even uses it to track his time on projects, improving his billing accuracy. This shift saved him countless hours and a lot of anxiety.

Decoding Crypto Taxes for Freelancers

The world of cryptocurrency adds another layer of complexity to freelance taxes. The IRS views cryptocurrency as property, not currency, which has significant implications for how it's taxed. This means every transaction involving crypto can be a taxable event.

When is Crypto Taxable?

Generally, you'll incur a taxable event when you:

- Sell crypto for fiat currency (USD): This is a capital gain or loss.

- Trade one cryptocurrency for another (e.g., Bitcoin for Ethereum): Also a capital gain or loss.

- Use crypto to pay for goods or services: This is considered selling the crypto for its fair market value at the time of the transaction, triggering a capital gain or loss.

- Receive crypto as payment for freelance services: This is considered ordinary income, taxed at your regular income tax rates, based on the fair market value of the crypto at the time you receive it.

The distinction between short-term (held for less than a year) and long-term (held for more than a year) capital gains is crucial, as long-term gains are typically taxed at lower rates. For ordinary income from services, it's just like receiving cash – you report the USD equivalent.

Record-Keeping for Crypto Transactions

This is paramount. You need to track:

- The date you acquired each unit of crypto.

- Your cost basis (what you paid for it, including fees).

- The date and fair market value (in USD) of each transaction (sale, trade, payment).

- The purpose of the transaction (e.g., payment for services, investment).

This can be incredibly tedious manually, especially with frequent trading. This is where specialized crypto tax software becomes invaluable. For more detailed guidance, always refer to official sources like the IRS Virtual Currency Guidance.

Real-World Example: Emily, the Web Developer Paid in Crypto

Emily, a freelance web developer, completed a project for a client who paid her 0.5 ETH when ETH was valued at $3,000. She immediately reports $1,500 as ordinary income. A few months later, she uses that 0.5 ETH to buy a new laptop when ETH is valued at $3,500. This triggers a capital gains event: she effectively "sold" her ETH for $1,750 (0.5 * $3,500), realizing a $250 capital gain ($1,750 - $1,500 original value). If she had held it for over a year, it would be a long-term gain; otherwise, it's short-term. Without meticulous tracking, Emily could easily miss reporting this gain, leading to potential issues.

Compliance & Avoiding Pitfalls

Staying compliant isn't just about avoiding penalties; it's about building a sustainable and stress-free freelance business. Ignorance is rarely an excuse in the eyes of tax authorities.

Proactive Organization is Key

Don't wait until April 14th to gather your documents. Make tax and accounting a regular part of your business operations. Set aside an hour each week or a few hours each month to reconcile accounts, categorize transactions, and review your financial health. This consistent effort will save you immense stress and time later on.

Don't Be Afraid to Ask for Help

If taxes feel overwhelming, or if your business (or crypto activity) becomes complex, hiring a qualified tax professional (CPA or Enrolled Agent) is one of the best investments you can make. They can help you identify all eligible deductions, navigate complex crypto rules, ensure compliance, and even represent you if there's an audit. Their expertise can often save you more than their fees.

Common Mistakes to Avoid:

- Mixing Personal & Business Funds: We've said it before, but it bears repeating.

- Ignoring Estimated Taxes: Underpaying or missing quarterly payments can lead to penalties.

- Poor Record Keeping: No receipts, no deductions. It's that simple.

- Not Understanding Crypto Basics: Assuming crypto isn't taxable or that only selling for fiat matters.

- Missing Deductions: Leaving money on the table because you didn't track eligible expenses.

Beyond tax compliance, remember that as a small business owner, other regulatory aspects might apply to you, especially if you handle client data. Understanding broader compliance, such as data privacy regulations, can be just as crucial for your business's reputation and legal standing. For instance, if you're dealing with clients in certain regions, you might need to consider GDPR Compliance Software for Small Business: Your Easy Guide to ensure you're handling personal data correctly. It's all part of running a professional and responsible operation.

For further insights into general business compliance, you might find resources from the Small Business Administration helpful.

Tools & Resources to Simplify Your Life

Leveraging the right tools can transform your tax and accounting experience from a headache to a manageable task. Here are some categories to consider:

- Accounting Software:

- QuickBooks Self-Employed: Tailored specifically for freelancers, tracking income, expenses, mileage, and estimated taxes.

- FreshBooks: Excellent for invoicing, time tracking, and expense management.

- Wave Accounting: A free option for basic accounting, invoicing, and receipt scanning.

- Crypto Tax Software:

- CoinTracker: Integrates with numerous exchanges and wallets, calculates gains/losses, and generates tax reports.

- Koinly: Similar to CoinTracker, offering comprehensive tracking and reporting for various crypto activities.

- TaxBit: Another robust option for managing and reporting crypto taxes.

- Receipt Tracking Apps:

- Expensify: Snap photos of receipts, and it extracts key information.

- Evernote/Google Drive: Simple cloud storage for digital copies of all your financial documents.

- Professional Help:

- Certified Public Accountants (CPAs): Ideal for complex situations, tax planning, and audit representation.

- Enrolled Agents (EAs): Federally licensed tax practitioners who specialize in taxation and can represent taxpayers before the IRS.

Remember, the best tool is the one you'll actually use consistently. Don't overcomplicate it; start with what feels manageable and scale up as your business grows.

Frequently Asked Questions

Q: Do I really need to pay estimated taxes quarterly?

A: Yes, if you expect to owe at least $1,000 in taxes for the year. The IRS requires you to pay income tax as you earn it. If you don't, you could face penalties for underpayment. It's better to pay a little extra and get a refund than to underpay and owe penalties.

Q: What's the difference between a short-term and long-term capital gain for crypto?

A: A short-term capital gain comes from selling crypto you've held for one year or less. These gains are taxed at your ordinary income tax rates. A long-term capital gain comes from selling crypto you've held for more than one year, and these are typically taxed at lower, more favorable rates.

Q: Can I deduct my health insurance premiums as a freelancer?

A: Yes, generally. If you're self-employed and not eligible to participate in an employer-sponsored health plan (either your own or your spouse's), you can deduct the premiums you pay for medical, dental, and qualified long-term care insurance for yourself, your spouse, and your dependents. This is an "above-the-line" deduction, meaning it reduces your adjusted gross income (AGI).

Q: What if I only made a small amount of money freelancing? Do I still need to report it?

A: If your net earnings from self-employment are $400 or more, you are required to file a tax return and pay self-employment taxes. Even if it's less than $400, it still counts as income and must be reported on your income tax return (though you might not owe self-employment tax).

Q: Is it better to be a sole proprietor or form an LLC for tax purposes?

A: For tax purposes, a single-member LLC is typically taxed as a sole proprietorship by default. The main difference is legal liability protection. An LLC separates your personal assets from your business liabilities. For tax purposes, you'll still report your income and expenses on Schedule C of your personal tax return. However, an LLC can elect to be taxed as an S-Corp or C-Corp, which can offer different tax advantages depending on your income level and business structure. It's best to consult with a tax professional to determine the optimal structure for your specific situation.

Conclusion

Freelancing offers incredible freedom, but it also demands a proactive approach to your financial responsibilities. By understanding the basics of freelance tax, embracing diligent accounting practices, and navigating the nuances of crypto taxation, you can transform potential headaches into manageable tasks. Remember, good financial hygiene isn't just about avoiding penalties; it's about empowering your business to thrive.

Don't let tax season catch you off guard. Start organizing your finances today, explore the tools available, and don't hesitate to seek professional guidance when needed. Your future self (and your wallet) will thank you!